Personal Accident Insurance with Rider Option (Additional of Life Protection, Health Protection and Critical Illness Benefits)

Comprehensive family protection with the freedom to choose your own coverage

Providing comprehensive protection for your family will always be your top priority. With the right insurance protection, you can ensure that you and your loved ones are financially secure against unforeseen risks.

Given the many risks that may arise, you need insurance that suits your needs and financial capability — not only health insurance but also life protection against accidents and critical illnesses.

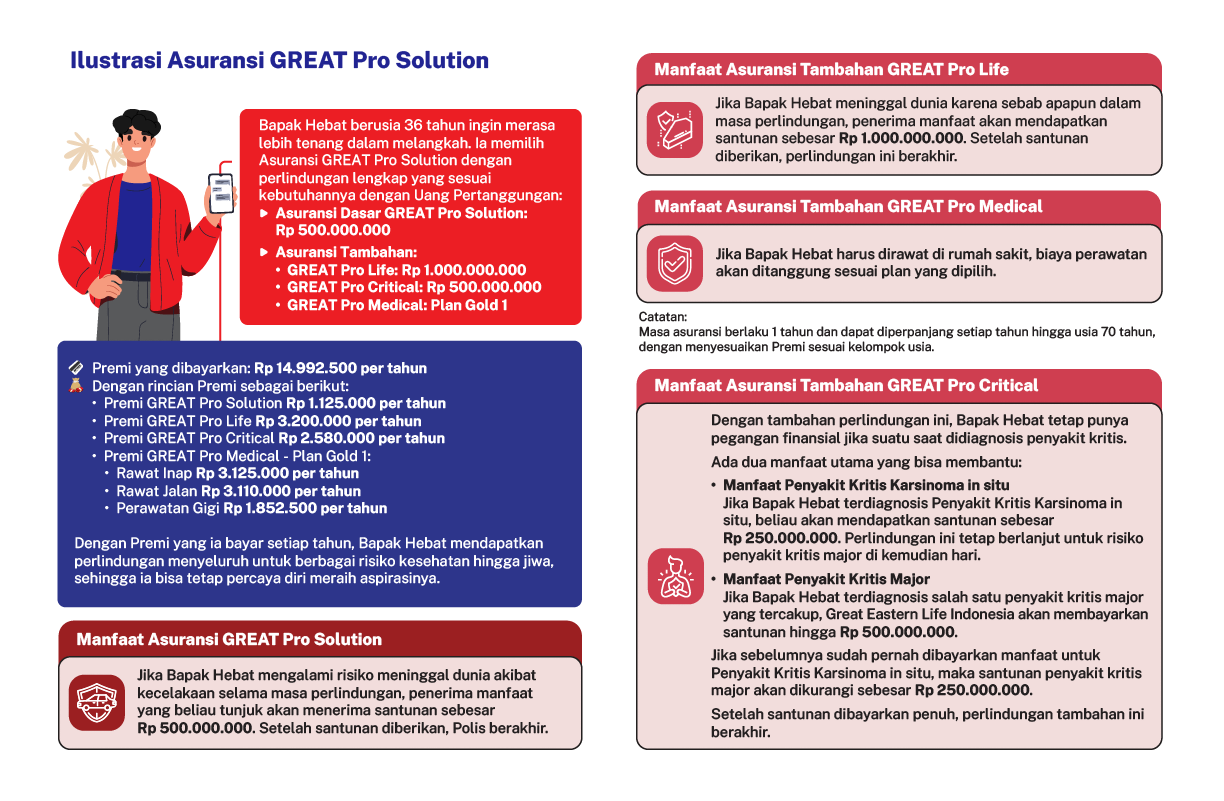

Because every individual has different protection needs, Great Eastern Life Indonesia presents GREAT Pro Solution — a life insurance product with Death Benefit due to Accident (Personal Accident), complemented by a variety of optional riders that you can choose to meet your specific needs, such as Hospitalization, Outpatient Care, Dental Care (cashless), Critical Illness Benefit, and Death Benefit due to any cause.

This product allows you to tailor your coverage according to your lifestyle and financial situation, giving you peace of mind for you and your family.

GREAT Pro Solution is available through Bank CTBC Indonesia, the ideal choice for those who value flexibility and maximum protection from a trusted insurance provider.

Available Optional Riders

GREAT Pro Life Rider

GREAT Pro Critical Rider

GREAT Pro Medical Rider

Key Benefits

Comprehensive Protection

Enjoy complete protection with optional riders you can choose based on your needs — including hospitalization, outpatient and dental benefits (cashless), critical illness coverage, and death benefit due to any cause.

Affordable and Flexible Premiums

Premiums can be adjusted according to your financial capacity and desired protection level.

Product Details

Description | Details |

Type of Product | Life Insurance with Personal Accident and Additional Health Benefits |

Currency | Indonesian Rupiah (IDR) |

Eligible Entry Age | Insured: 1 month – 65 years |

Policy Term | 1 year, renewable annually until the Insured reaches age 70 |

Premium Payment Frequency | Annual |

Premium Payment Term | Regular, renewable before the end of the policy period |

Minimum Premium | IDR 2,000,000 per year (including rider premium) |

Sum Assured | Minimum: IDR 5,000,000 |

Note | Policyholder must purchase at least one rider (Life, Critical, or Medical). The base plan alone cannot be purchased. |

GREAT Pro Life Rider

Description | Details |

Eligible Entry Age (Insured) | 18 – 65 years |

Policy Term | Follows the base plan (GREAT Pro Solution) |

Sum Assured | Minimum IDR 100,000,000 – Maximum IDR 1,000,000,000 |

Waiting Period | None |

Survival Period | None |

Grace Period for Premium Payment | 30 calendar days |

Free Look Period | 14 calendar days from the date the policy is received |

GREAT Pro Critical Rider

Description | Details |

Eligible Entry Age (Insured) | 18 – 65 years |

Policy Term | Follows the base plan (GREAT Pro Solution) |

Sum Assured | Minimum IDR 100,000,000 – Maximum IDR 1,000,000,000 |

Waiting Period & Survival Period | None |

Grace Period for Premium Payment | 30 calendar days |

GREAT Pro Medical Rider

Description | Details |

Eligible Entry Age (Insured) | 1 month – 65 years |

Policy Term | Follows the base plan (GREAT Pro Solution) |

Waiting Period | 30 calendar days from policy commencement date |

Survival Period | None |

Grace Period for Premium Payment | 30 calendar days from the premium due date |

Sum Assured | Based on the selected plan’s benefits for hospitalization, outpatient, and dental care |

Disclaimer

GREAT Pro Solution is a life insurance product issued by PT Great Eastern Life Indonesia (“Great Eastern Life Indonesia”) and not a product of PT Bank CTBC Indonesia (“Bank CTBC”). Bank CTBC is neither an insurance agent nor a broker of Great Eastern Life Indonesia and bears no responsibility for this product or its policy contents. This product is not a bank deposit, is not guaranteed by the Government, and is not covered by the Indonesia Deposit Insurance Corporation (LPS). Premiums paid by the Policyholder include acquisition, administrative, and distribution costs, as well as commissions to Bank CTBC and/or sales representatives (if any). All information provided herein is subject to the terms and conditions of the policy and may be amended from time to time in accordance with prevailing regulations. This product has been approved by the Financial Services Authority (Otoritas Jasa Keuangan – OJK).