Comprehensive Protection Against Critical Illness Risks

A fast-paced lifestyle and poor dietary habits can increase your risk of developing critical illnesses.

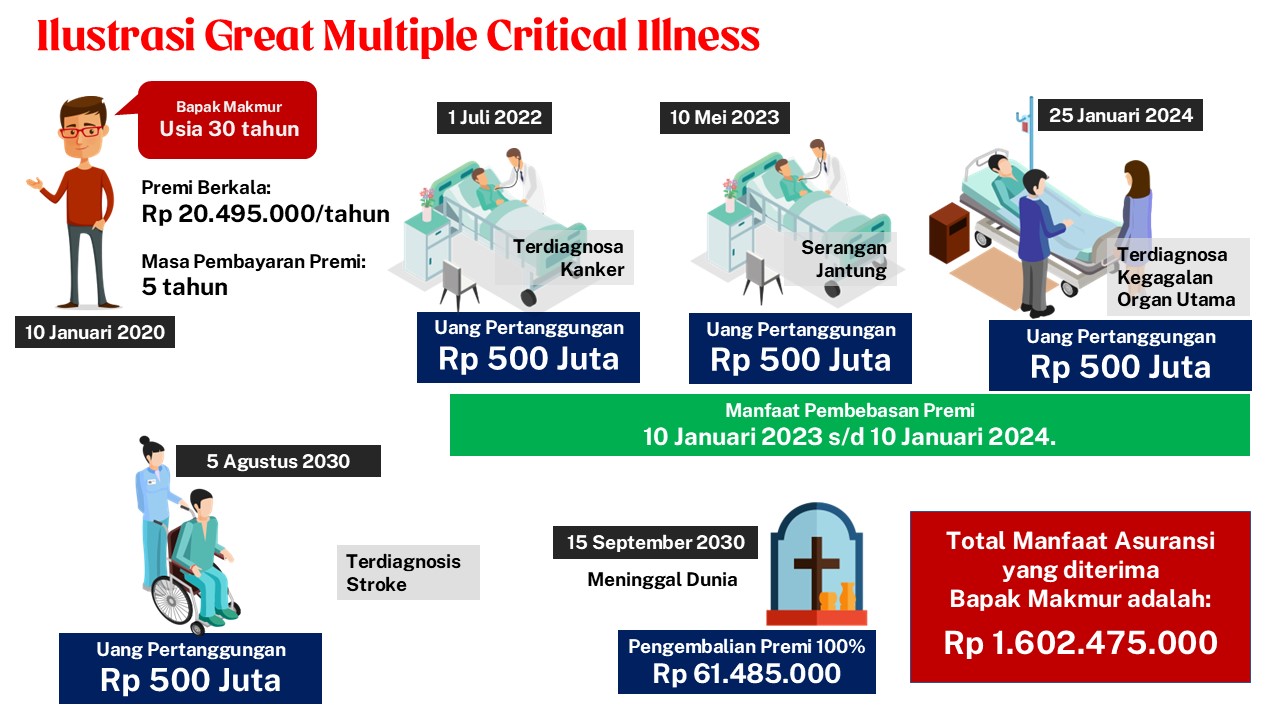

GREAT Multiple Critical Illness provides comprehensive financial protection against critical illness risks with coverage of up to 4 times claims, complemented by 100% Premium Refund Benefit, Premium Waiver Benefit, Death Benefit, and Diagnosis Confirmation Verification.

For even greater protection, this plan can be enhanced with an additional rider – GREAT Early CI, which offers coverage for Minor (Early Stage) Critical Illnesses.

Key Benefits of GREAT Multiple Critical Illness

Up to 4x Claims

Receive protection for up to 4x claims for different major critical illnesses as stated in the policy terms.

100% Return of Premium

Enjoy a 100% return of total premiums paid at the end of the policy term — whether or not a claim has been made or Insured dies.

Comprehensive Protection for 59 Major Critical Illnesses

Covers 59 types of major critical illnesses, including heart disease, cancer, stroke, and more.

Optional Additional Coverage – GREAT Early CI

The GREAT Early CI rider provides additional protection against 63 minor (early-stage) critical illnesses, giving you earlier financial support upon diagnosis.

Product Details – GREAT Multiple Critical Illness

Description | Details |

Type of Insurance | Life Insurance with Critical Illness Benefits |

Currency | IDR |

Policyholder’s Entry Age | 18 – 80 years |

Insured’s Entry Age | 14 days – 65 years |

Age Calculation Method | Last birthday |

Coverage Period | Up to the Insured’s age of 80 |

Premium Payment Term | 5 years (annual, semi-annual, or monthly payment options) |

Premium | Based on gender, age, and Sum Assured |

Minimum Sum Assured | IDR 250 million |

Maximum Sum Assured | Adults: IDR 5 billion per lifeChildren (up to age 17): IDR 2 billion per life |

Waiting Period | 90 calendar days from the policy commencement date |

Grace Period for Premium Payment | 45 calendar days from the premium due date |

Free Look Period | 14 calendar days from the date the policy is received |

Premium Payment Method | Regular premium payments over 5 years |

Waiting Period for Critical Illness & Diagnosis Verification | 90 calendar days from policy commencement |

Product Details – GREAT Early CI (Rider)

Description | Details |

Type of Insurance | Additional Insurance for Minor (Early-Stage) Critical Illness |

Currency | IDR |

Policyholder’s Entry Age | 18 – 80 years |

Insured’s Entry Age | 14 days – 65 years |

Age Calculation Method | Last birthday |

Coverage Period | Up to the Insured’s age of 80 |

Premium Payment Term | Until the end of the coverage period (even if the base policy premium payment is completed) |

Premium | Based on gender, age, and Sum Assured |

Sum Assured | 20% of the Base Plan’s Sum Assured (GREAT Multiple Critical Illness) |

Waiting Period | 90 calendar days from the rider commencement date |

Grace Period for Premium Payment | 45 calendar days from the premium due date |

Free Look Period | 14 calendar days from the date the policy is received |

Benefits of GREAT Early CI

If the Insured is first diagnosed with any of the 63 Minor (Early-Stage) Critical Illnesses within the coverage period and after the waiting period, 100% of the Rider Sum Assured (equivalent to 20% of the Base Plan’s Sum Assured) will be paid.

The payment of this rider benefit does not reduce the benefits of the base plan.

The benefit is payable only if the Insured is alive at the time of diagnosis.

If both Minor and Major Critical Illness benefits are payable simultaneously, both benefits will be paid according to the policy terms.

Disclaimer

GREAT Multiple Critical Illness and GREAT Early CI is a life insurance product of PT Great Eastern Life Indonesia (‘Great Eastern Life Indonesia’), not a product of PT Bank CTBC Indonesia (‘Bank CTBC’) and Bank CTBC is neither an insurance agent nor an insurance brokerage company of Great Eastern Life Indonesia. Great Eastern Life Indonesia is fully responsible for the GREAT Multiple Critical Illness and GREAT Early CI product and the contents of the insurance policy issued for the GREAT Multiple Critical Illness and GREAT Early CI product, so CTBC Bank is not responsible in any form for the GREAT Multiple Critical Illness and GREAT Early CI product and the contents of the policy issued in connection with the GREAT Multiple Critical Illness and GREAT Early CI product. GREAT Multiple Critical Illness and GREAT Early CI is not a bank deposit product, thus it is not included in the government guarantee programme or the Deposit Insurance Corporation. The premium paid by the Policyholder is inclusive of acquisition, administration, fund management, bank commission and marketing commission (if any). The information in this document should be read in conjunction with and subject to the terms of the Policy and any other terms related to the GREAT Multiple Critical Illness and GREAT Early CI product currently in force and any future amendments.