It is a traditional life insurance product with a Single Basic Premium and Regular Basic Premium (currently not available) payment option for peace of mind of inheritance & financial support in the future.

Product Key Selling

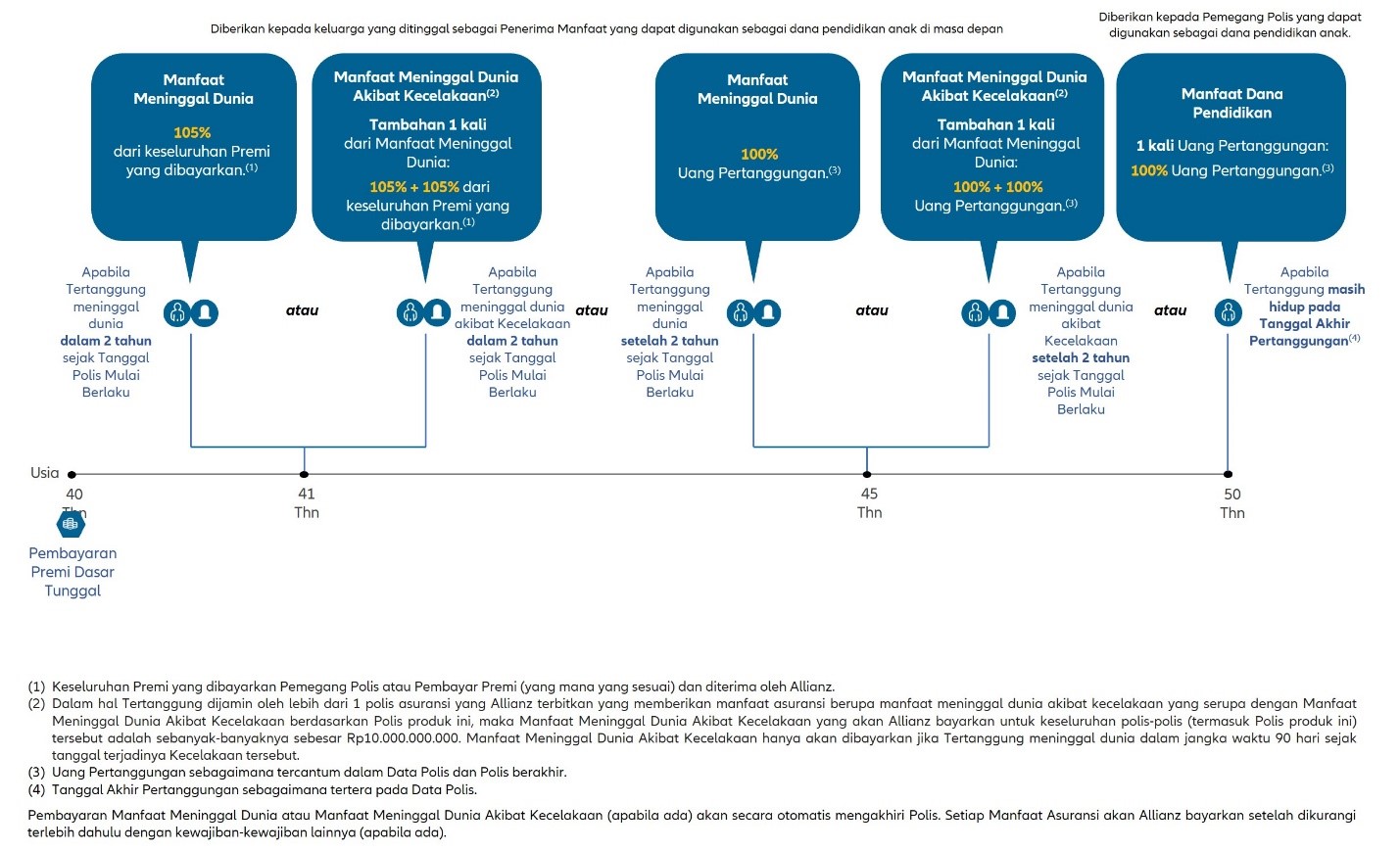

Death Benefit value of 105% of the total Premium paid(1) if the Insured dies within 2 Policy Years(2) or value of the Sum Assured(3) if the Insured dies after 2 Policy Years(2).

Accidental Death Benefit(4) in the form of an additional 1 time of Death Benefit(5).

Education Fund Benefit (which is a maturity benefit) of 1 time the Sum Assured(6) if the insured is still alive on the End of Coverage Date(7)

Short Insurance Period for 10 years with a choice of Rupiah & US Dollar currencies as needed.

Choice of payment method for Single Basic Premium & annual Regular Basic Premium (currently not available) for the first 2 Policy Years as needed.

Policy submission without medical examination for a maximum of Sum Assured up to IDR 10,000,000,000/ USD 770,000. (8)

(1) The entire Premium paid by the Policyholder or Premium Payor (as appropriate) and received by Allianz.

(2) Policy Year from the Effective Policy Date

(3) 100% of the Sum Assured if the Insured dies after 2 years from the Effective Policy Date, as stated in the Policy Data or Endorsement, if any.

(4) In the event that the Insured is guaranteed by more than 1 insurance policy issued by Allianz which provides insurance benefits in the form of death benefits due to Accident similar to Accidental Death Benefit based on the Allianz Life Secure PINTAR Policy (dana PendidIkaN diserTAi pRoteksi), then the Accidental Death Benefit that Allianz will pay for all policies (including the Allianz Life Secure PINTAR Policy (dana PendidIkaN diserTAi pRoteksi) is a maximum of IDR 10,000,000,000.

(5) 105% + 105% of the total Premium paid (if the Insured dies within 2 Policy Years) or 100% + 100% of the Sum Assured (if the Insured dies after 2 Policy Years), as stated in the Policy Data or Endorsement, if any. Accidental Death Benefit will only be paid if the Insured dies within 90 days from the date of the Accident.

(6) 100% Sum Assured

(7) End of Coverage Date as stated in Policy.

(8) Policy submission for Insured, specifically for adult age & income earner with Simplified Issuance Offer (SIO) underwriting type. For Policy submission with Sum Assured exceeding IDR 10,000,000,000 / USD 770,000 will be subject to Full Underwriting.

Detail Product

a. | Insurance Type | : Traditional |

b. | Currency | : IDR & USD |

c. | Minimum Premium |

|

| Single Basic Premium | : Rp 100.000.000 / USD 10.000 |

| Regular Basic Premium (2 years payment) | : Rp 50.000.000 / USD 5.000 |

d. | Premium Payment Method* | : Single Basic Premium & Regular Basic Premium |

e. | Policyholder Entry Age | : Minimum 18 years old (nearest birthday) |

f. | Insured Entry Age | : 1 month – 65 years old (nearest birthday) |

g. | Insurance Period | : 10 years |

*Premium payment method currently available for Single Basic Premium Payment

Benefit Illustration Example

Disclaimer

Allianz Life Secure PINTAR (dana PendidIkaN diserTAi pRoteksi) is a traditional individual life insurance product issued by PT Asuransi Allianz Life Indonesia. PT Bank CTBC Indonesia ("Bank") only acts as a reference provider for Allianz Life Secure PINTAR (dana PendidIkaN diserTAi pRoteksi). Allianz Life Secure PINTAR (dana PendidIkaN diserTAi pRoteksi) is not a product of the Bank so that the Bank is not responsible for any and all claims and any risks whatsoever for the Policy issued by PT Asuransi Allianz Life Indonesia. Allianz Life Secure PINTAR (dana PendidIkaN diserTAi pRoteksi) is not guaranteed by the Bank and its affiliates and is not included in the scope of the guarantee program of the Government of the Republic of Indonesia or the Deposit Insurance Corporation ("LPS"). PT Bank CTBC Indonesia is licensed and supervised by the Financial Services Authority and is a participant in the Deposit Insurance Corporation (LPS) guarantee. The management of Allianz Life Secure PINTAR products (dana PendidIkaN diserTAi pRoteksi) is carried out by PT Asuransi Allianz Life Indonesia and is the responsibility of PT Asuransi Allianz Life Indonesia. The premium paid includes a commission for the Bank. A more complete explanation of the terms, conditions including detailed charges and exclusions can be found in the General Product and Service Information Summary (RIPLAY) and Policy.