It is a traditional life insurance product with regular Premium payments that provides Death Benefit until the Insured up to Age 100 years old, Basic Insurance Premium Waiver Benefit, and Sum Assured Booster Benefit when the Insured up to Age 75 years old.

Product Key Selling

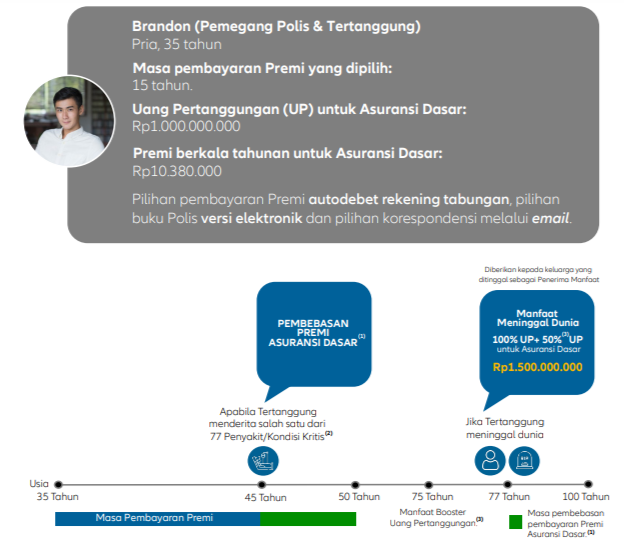

Death Benefit will be given if the Insured dies during the Insurance Period, Allianz shall pay the Death Benefit to the Beneficiary 100% of the Sum Assured for the Basic Insurance.

Sum Assured Booster Benefit will be given if the Insured up to Age 75 years old. Allianz will provide booster benefits in the form of an increase in Sum Assured for Basic Insurance under the following conditions:

The Sum Assured for Basic Insurance will be increased to 50% (50% Sum Assured Booster) provided that the Policyholder has met all of the following criteria*.

The Sum Assured for Basic Insurance will be increased to 25% (25% Sum Assured Booster) provided that: (i) the Policyholder fails to meet any one of the Sum Assured Booster Requirements. (ii) has meet the Sum Assured Booster Requirements, and has received a Sum Assured Booster Benefit in the form of an increase in Sum Assured to 50% Sum Assured Booster, but no longer meets any of the Sum Assured Booster Requirements.

The Sum Assured Booster Requirements:

The Policyholder chooses to pay Premium by means of automatic debit via credit card or savings account;

Policyholder chooses to send and receive correspondence via email;

The Policyholder chooses the electronic version of the Policy Book;

The Policyholder will not make any changes to the Premium payment method (automatic debiting) during the Insurance Period;

Since the Policy Effective Date, no Premium has been settled after the expiry of a Grace Period;

The Policyholder has never changed the Policy into a Reduced Paid-Up Policy. The Sum Assured Booster Requirements set out in points (i), (ii) and (iii) above must be met during the submission of SPAJ, as stated in SPAJ.

Basic Insurance Premium Waiver Benefit will be given if the Insured suffers from any one of the 77 Critical Illnesses/Conditions, and the claim for the Basic Insurance Premium Waiver Benefit has been approved by Allianz, Allianz will provide the Basic Insurance Premium Waiver Benefit in the form of a waiver of Basic Insurance Premium payment, starting from the next Premium Due Date (after the date of the claim is approved by Allianz) until the end of the Premium Payment Period.

This Basic Insurance Premium Waiver Benefit shall apply if the Insured meets all of the following requirements:

Signs or symptoms of Critical Illness/Condition experienced by the Insured or date of diagnosis of Critical Illness/Condition of the Insured did not occur within 80 days since the Policy Effective Date or date of recovery, whichever is later;

The Insured is diagnosed with any one of the Critical Illnesses/Conditions during the Premium Payment Period in accordance with the provisions of this Policy;

The Policyholder or the Premium Payor (as the case may be) must continue to pay Premium until the date this Basic Insurance Premium Waiver Benefit claim is approved.

Basic Insurance Premium Waiver Benefit shall have no impact on the Booster Benefit Sum Assured.

The Death Benefit in the amount of the paid Sum Assured payable for the Insured under and/or up to Age 5 years old shall be made under the following terms:

Age of the Insured at the time of death (year) | % of the Death Benefit |

|---|---|

<1 | 20% |

2 | 40% |

3 | 60% |

4 | 80% |

>5 | 100% |

The Death Benefit payment shall be deducted first by other outstanding obligations (if any) from Policyholder to Allianz.

Product details | ||

|---|---|---|

a | Insurance type | : Traditional Life Insurance |

b | Currency | : IDR & USD |

c | Sum Assured |

|

Minimum Sum Assured | : IDR 200.000.000 / USD 20.000 | |

Maximum Sum Assured for Children (up to Age 17 years old) | : IDR 3.000.000.000 / USD 240.000 | |

d | Premium Payment method | : Regular Premium (Annually, Semi-annually, Quarterly, and Monthly) |

e | Policyholder entry Age | : Minimum 18 years old (nearest birthday) |

d | Insured entry Age | : 1 month – 70 years old (nearest birthday)* *For Premium Payment Period 5 & 10 years. Insured entry Age for Premium Payment Period 15 years: 1 month – 59 years old (nearest birthday) |

g | Premium Payment Period | : 5, 10, or 15 years |

h | Insurance Period | Until the Insured up to Age 100 years old (nearest birthday). |

Benefit illustration example

Disclaimer

Allianz Life LegacyPro (“Insurance Product”) is an Insurance Product by PT Asuransi Allianz Life Indonesia (“Allianz”). PT Bank CTBC Indonesia (CTBC Bank) only acts as a party that refers Allianz Life LegacyPro products. The use of the CTBC Bank logo only indicates that CTBC Bank is working with Allianz in marketing of Allianz Life LegacyPro Product and does not mean that this insurance product is a CTBC Bank product. Allianz Life LegacyPro is not a CTBC Bank product so CTBC Bank is not responsible for any and all claims arising from the management of this product portfolio. Allianz Life LegacyPro is not guaranteed by CTBC Bank and its affiliates and is not included in the scope of the deposit guarantee program by LPS as referred to and regulated in Law No. 24/2004 regarding Deposit Insurance Corporation. CTBC Bank is not responsible for the insurance policies issued by Allianz. PT Bank CTBC Indonesia is licensed and supervised by the Otoritas Jasa Keuangan (OJK) and is a member of the Lembaga Penjamin Simpanan (LPS).